Our scholarships are now open! Click here to learn more.

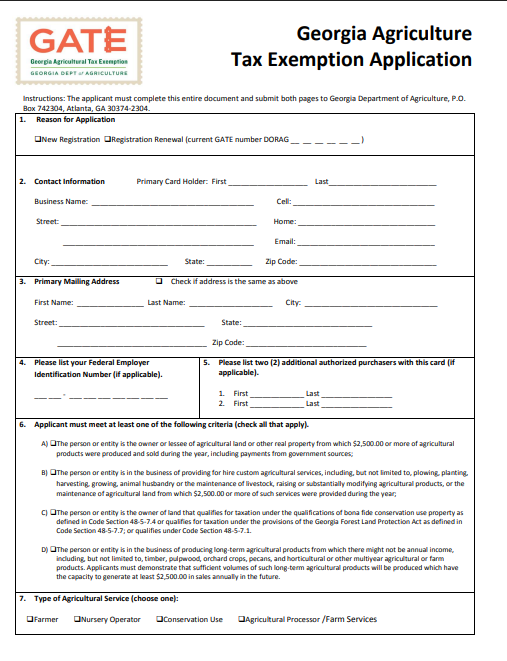

The Georgia Agriculture Tax Exemption program (GATE) is an agricultural sales and use tax exemption certificate issued by the Department of Agriculture that identifies its user as a qualified farmer or agricultural producer. The Georgia Agriculture Tax Exemption (GATE) is a program created through legislation, which offers qualified agriculture producers a sales tax exemption on agricultural equipment and production inputs. The program replaced the Agricultural Certification of Exemption (ST-A1) form. Registration is available today at https://forms.agr.georgia.gov/GATE/.

GATE cards expire December 31, and must be applied for every year. We must have your current GATE card on file before January 1 so there is no lapse in your tax exempt status. Once we taxes have been assessed on your account, we cannot remove them because those funds have already been allocated to the state of Georgia.